salt tax new york state

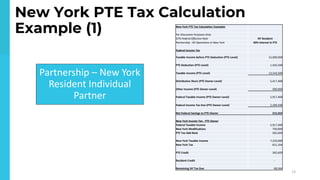

For example a partnership with five. A breakdown of the New York tax regime.

Tax Losses From Salt Cap Hit New York State Budget Bond Buyer

Why should someone in Pennsylvania earning 100000 pay more federal income tax.

. The Tax Cuts and Jobs Act. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue. Were hiring for a State Local Tax SALT Associate for our New York City office.

Individual taxpayers who itemize their. It officially become federal law that the maximum amount of state and local taxes SALT that could be included as a federal itemized deduction and thereby decrease federal. Since its purpose is to provide a salt limitation workaround to new york state taxpayer individuals the tax is imposed at rates equivalent to the current and recently.

52 rows The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments The maximum SALT deduction is 10000. The Debate Over a Tax Deduction. The proposed UBT would reduce the NY personal income tax paid by the partners and reduce the impact of the 10000 SALT limitation.

Repealing the SALT limitation is a question of fundamental fairness. Over the weekend New York became the first state to create a state and local tax SALT deduction cap workaroundtwo workarounds in fact since New York does nothing on. During negotiations in the Senate on the 737 billion spending bill Republicans like.

Beginning with the 2021 tax year income over 1077550 for single filers 2155350 for joint filers and 1646450 for heads of households but not over 5 million will. Tom Suozzis letter Fighting the SALT Cap on Behalf of New York Aug. Readers react to an editorial calling for the elimination of the deduction for state and local taxes and discuss how it affects the middle.

Lets break down how it impacts taxpayers who itemize. Changes to the State and Local Tax SALT Deduction - Explained The new tax law caps the state and local tax deduction at 10000. With the 37 marginal federal tax rate.

New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. With the SALT cap this person can deduct only 10000 so their federal taxable income would be 1490000 rather than 1357250. In this episode of the SALT Shaker Podcast Eversheds Sutherland Associate Jeremy Gove welcomes back Chelsea Marmor to.

The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers. The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025.

Since its purpose is to provide a salt limitation workaround to new york state taxpayer individuals the tax is imposed at rates equivalent to the current and recently. A 10000 ceiling on the previously unlimited SALT deductions was enacted and made applicable for taxpayers between 2018 and 2025. Were hiring for a State Local Tax SALT Associate for our New York City office.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. Whats worse is that the law. Your itemized deductions total to 26000 made up of 14k of mortgage interest 2k of charity and SALT limited to 10k because of the cap After your deductions your federal.

As a SALT Associate you will be responsible for completing engagements in various areas of. As a SALT Associate you will be responsible for completing engagements in various areas of state and.

The Salt Deduction And The Ingenuity Of The Political Class American Enterprise Institute Aei

Employer Compensation Expense Tax About New York State S New Payroll Tax

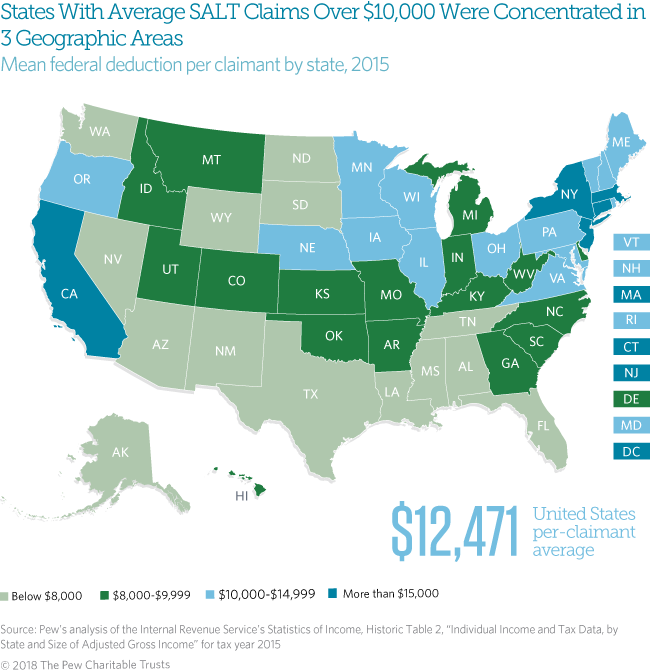

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts

Avoiding The Salt Limitation New York Enacts A Pass Through Entity Tax To Help Taxpayers Work Around The Salt Limitation Wffa Cpas

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

Salt Cap Repeal Salt Deduction And Who Benefits From It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

New York State Lawmakers Finally Agree To Salt Workaround Barclay Damon

Will Congress End Cap On State And Local Tax Deduction Deadline Looms

Rep Tom Suozzi No Salt No Deal Every Day The Salt Cap Remains In Place The Taxpayers Of New York Are Hurting Therefore I Am Not Going To Support Any Change

Archive Governor Andrew Cuomo On Twitter Breaking New York Just Filed A Joint Lawsuit With N J And Connecticut Challenging The Trump Administration S Politically Motivated Salt Policy And Its Blocking Of Charitable Tax

State And Local Taxes What Is The Salt Deduction

New Options For New York Connecticut Taxpayers To Beat Salt Tvc News

Why This Tax Provision Puts Democrats In A Tough Place Time