is nevada tax friendly for retirees

Nevada is extremely tax-friendly for retirees. With no income tax theres also no tax on 401k or IRA distributions.

Some States Are Lowering Taxes To Entice Retirees To Relocate Legacy Planning Law Group

All in all Nevada is a pretty friendly state for retirees.

. Nevada Retirement Income Nevada does not tax individual income retirement or otherwise. Youll pay no regular or retirement income tax and nevada property taxes are low. Types of retirees who might benefit from living in Nevada.

Kiplinger magazine rates the best states for retirement for taxes specifically as those that put a smaller burden on its residents in terms of state and local taxes. Social Security and Retirement Exemptions. Both do not have a state income tax.

Certain cities in Nevada such as Las Vegas may. If youve visited Nevada chances are youve been to Las Vegas best known for its casinos. Florida is known for having a high sales tax while Nevada tax advantages include low property and real estate taxes.

24 cents per gallon. The state ranked 28th highest for property tax collections in 2020. Retirement income tax breaks start at age 55 and increase at age 65.

In fact you will be hard-pressed to find a better state for retirement based on taxation. Retirement income is only one factor in figuring out which states give retirees the best tax breaks. Taxes in Nevada vs Florida.

Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming. Photo by Sean Pavone from Shutterstock 6. As a percent of value property tax paid is 84.

Property taxes are at an average rate of 693 per 100000 in home value and there is zero estate or inheritance taxes. States With No Income Tax Eight states dont impose an income tax on earned income as of 2021. The state income tax is very low starting at 3 percent and stands out as a great place for retirees for other non tax-related reasons such.

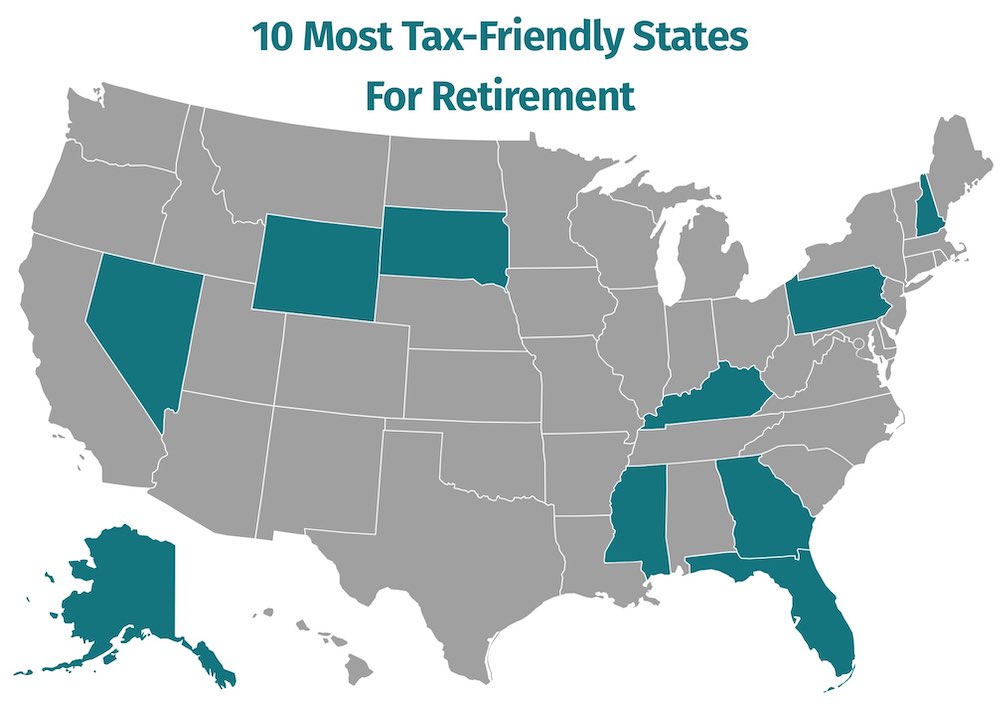

Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees. Average state and local sales tax. Is Nevada Tax Friendly For Retirees.

Retirees can cash in their retirement funds and collect their social security checks without worrying about a large tax burden. You have a good healthcare system low property taxes and no personal income tax. 5 - Nevada Nevada is the place if you love a dry climate and the desert as your backdrop.

They are not taxed. High property taxes have a lot to do with the state not making it. Average property tax 607 per 100000 of assessed value 2.

Property tax exemption for seniors 65 and older or surviving spouses 50 of first 200000 in actual value exempt No estate or inheritance tax. 30761 TAX RATING FOR RETIREES. Pension Income Nevada does not tax public pension income.

651319 SHARE OF POPULATION 65. But some retirees consider it one of the best places to. Marginal Income Tax Rates.

Although the Last Frontier has no state income or sales tax it isnt necessarily a tax haven for all retirees. Nevada Nevada also known as The Silver State is situated in the Western region of the United States with a population of roughly 308 million. See our Tax Map for.

Flat 463 income tax rate. Taxes are on the mind of many retirees. The state has the highest percentage of workers who are 65 years old or older.

Nevada has no income tax. Nevada The western state of Nevada is yet another tax-friendly state for retirees with no state taxes. Nevada is a very tax-friendly state towards retirees.

The state is scaring off seniors with its egregious property crime problem and the difficulty of accessing quality health care exacerbated. At 83 Total tax burden in Nevada is 43rd highest in the US. Alaska Nevada and Wyoming which do not have income tax are much friendlier have a lesser impact.

California may be beautiful and popular but state income tax can reach 133 percent. 10th on the list was Tennessee followed by Arizona Alabama Colorado South Carolina Nevada. Nevada is a very tax-friendly state towards retirees.

3 above the national average PER CAPITA INCOME FOR POPULATION. Nevada also has the fifth best taxpayer ranking by WalletHub. The state income tax bracket is as near to the ground as 463 and retirees can get a fair-minded presumption on retirement income.

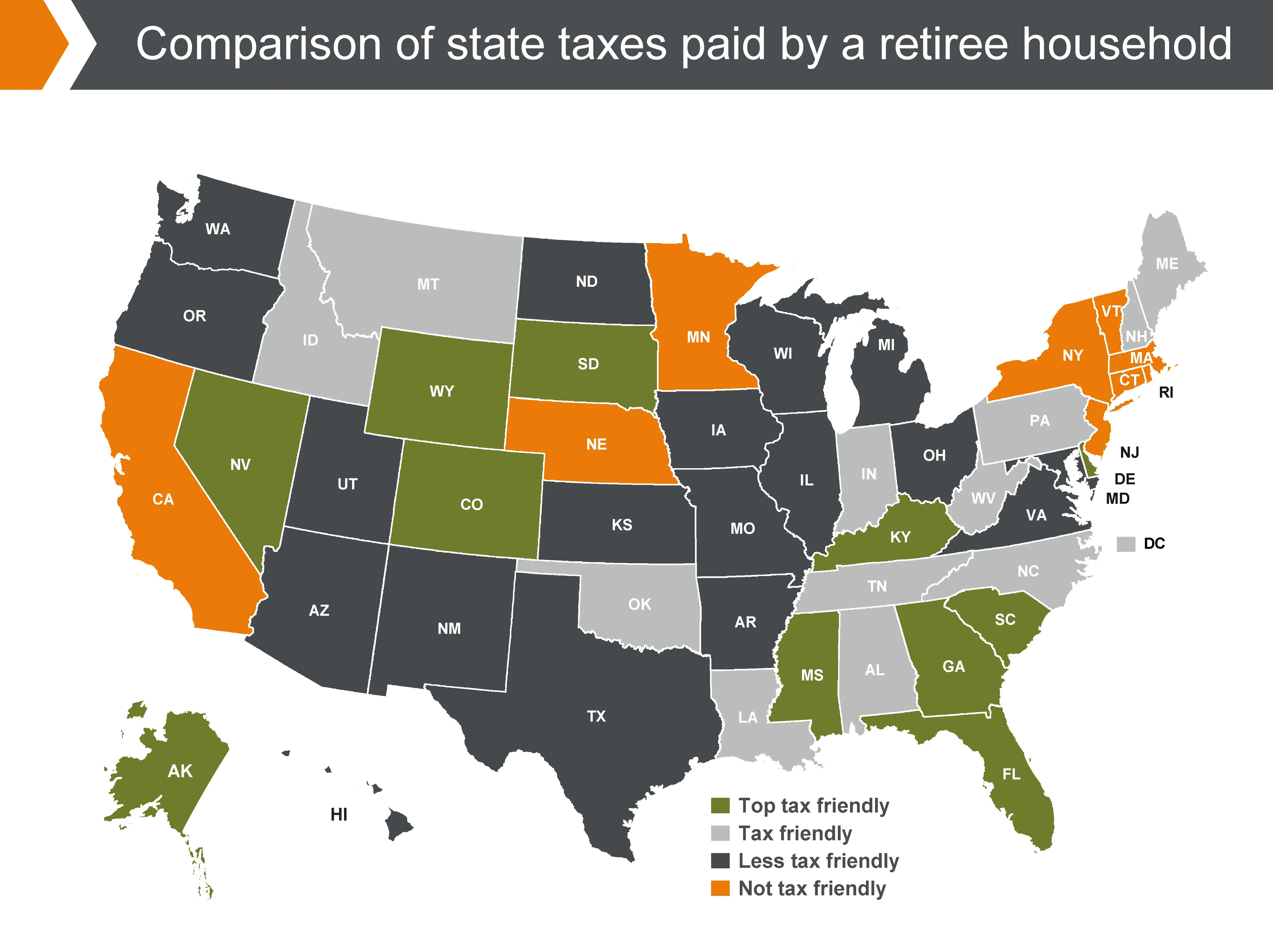

Three main types of state taxesincome tax property tax and sales taxinteract to. In the case of Florida vs Nevada taxes either way you win in one aspect. Most residents pay 104 percent of the propertys market value.

Regardless of what type of retirement youre after there are plenty of decent places for you to settle down in NV including Reno and Las Vegas. New Hampshire also has the lowest property crime rate in. Nevada does not tax private pension income.

Its position as one of the most tax friendly states for retirees make it even more attractive for those looking for that special place to enjoy their retirement. But even if youre not into the desert travel up towards Reno for a change of pace. 149 COST OF LIVING FOR RETIREES.

Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if youre retired or youre about to retire. State sales tax is 685 but localities can increase that to 81. Skip to main content.

Top 10 Most Tax Friendly States For Retirement 2021

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

State By State Guide To Taxes On Retirees Kiplinger Retirement Retirement Advice Tax

State By State Guide To Taxes On Retirees Retirement Tax Retirement Income

Nevada Tax Advantages And Benefits Retirebetternow Com

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Income Retirement Retirement Locations

Tax Friendly States For Retirees Best Places To Pay The Least

Tax Friendly States For Retirees Best Places To Pay The Least

The 10 Best Places To Retire In Nevada Newhomesource Best Places To Retire Nevada Places

These Are The Best And Worst States For Taxes In 2019

7 States That Do Not Tax Retirement Income

7 Business Opportunities In The State Of Nevada Business Opportunities Make Business Business Law

States With The Highest And Lowest Taxes For Retirees Money

Nevada Retirement Tax Friendliness Smartasset

Nevada Retirement Tax Friendliness Smartasset

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map